If you’re looking For Potentially HUGE GAINS in the short term OTC:QYOUF could be the dream company of 2018. Savvy traders are already taking a position and its still priced under $.50, but that may not last for much longer. The Team behind QYOUF is 5 -star and that will not stay quiet for long. As volume increases so will the price so getting in at the current price will not last long.

It’s no accident that “young” and “YouTube” start from the same place. From little kids to the emerging economic force of 92 million Millennials, the digital generation spends a whole lot of time watching streaming video on the little screen.

They grew up in a world where you didn’t have to park in front of a big TV to catch your favorite shows. And it’s not just U.S. kids either: the only screen most of the world’s 4.3 billion people under the age of 35 will ever know is the one on their phone or other mobile device.

That’s the vast entertainment market a little company called QYOU Media (OTC: QYOUF) was created to capture. The founders (more about them later) know what makes kids tick — they previously built little companies you might’ve heard of called MTV and Lionsgate — and now they want to bring that magic to a new generation of investors.

(Don’t forget, QYOU is the company and, if you trade in Canada, the stock ticker. South of the border in the USA, QYOUF is the chart to watch.)

Wind the clock back to the mid-1980s. MTV was an unknown quantity, new on the market and bringing in barely $60 million a year. But channel sales were ramping 33% a year and the company was worth $225 million.

Barely a year later, investors who took a chance on that IPO were dazzled to get a $667 million buyout offer from Viacom. End-to-end profit: 196% in exchange for 13 short months of “patience.” That’s in the TRIPLE-the-money zone!

Think of QYOU as an update on that model retooled for the age of mobile devices. They focus on short-form programming, “snack-size” video formats that are as addictive as potato chips for young attention spans. At that age, you’re always up to watch just one more 3-minute hit, and even if you don’t like it, you’ll stay tuned to try the next one.

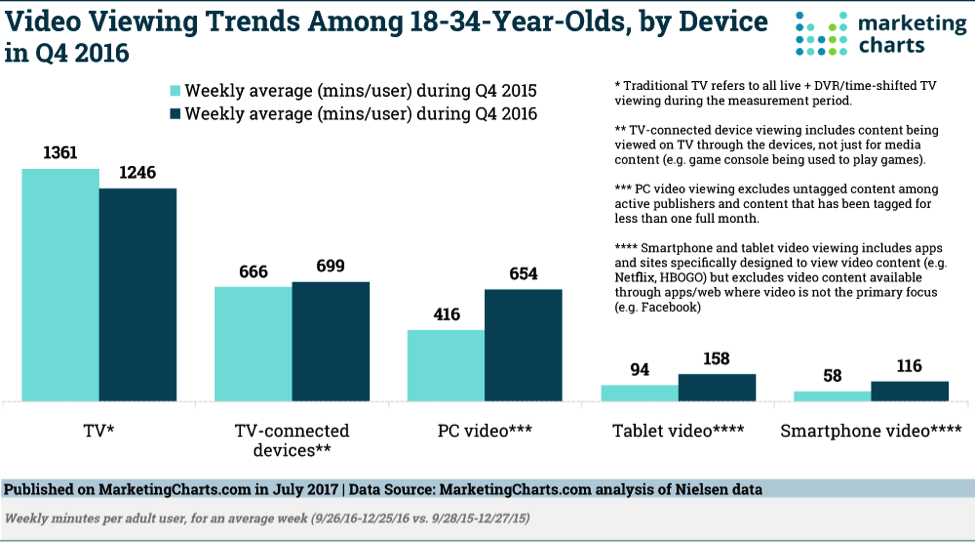

That’s probably why the amount of time the very audience advertisers covet most — the 18- to 34-year-old crowd — spends watching traditional TV has plunged 60% since 2011. The boob tube is just too slow for these kids. Meanwhile, consumption of video on computers, tablets and phones has soared 63% in just the last year alone.

QYOU is where the kids are going. Granted, the great migration here in the U.S. is still in the early stages, but with people in this age group already spending an average of 15.4 hours a week in front of the little screen, it’s clear that this is a platform that’s moving fast toward critical mass . . . if it isn’t there now.

Multiply 92 million Millennials by 15.4 hours per week and you see the current opportunity. That same age group still wastes another 20 hours a week parked in front of the TV, so there’s still plenty of room to keep capturing those eyeballs.

I know you’re probably thinking, “isn’t there already a YouTube?” There is. It’s arguably a victim of its own success, with a staggering 600 hours of new video uploaded to the site every minute to feed a worldwide audience hungry to consume north of 1 billion hours of that footage every day.

That’s too much video for kids to track. To be honest, a lot of it is junk that next to nobody will ever see . . . endless dog birthday party movies and weird “experimental’ clips and not many truly viral sensations. QYOU has a proprietary system that tracks the trends and serves up just the videos its target market actually wants to see.

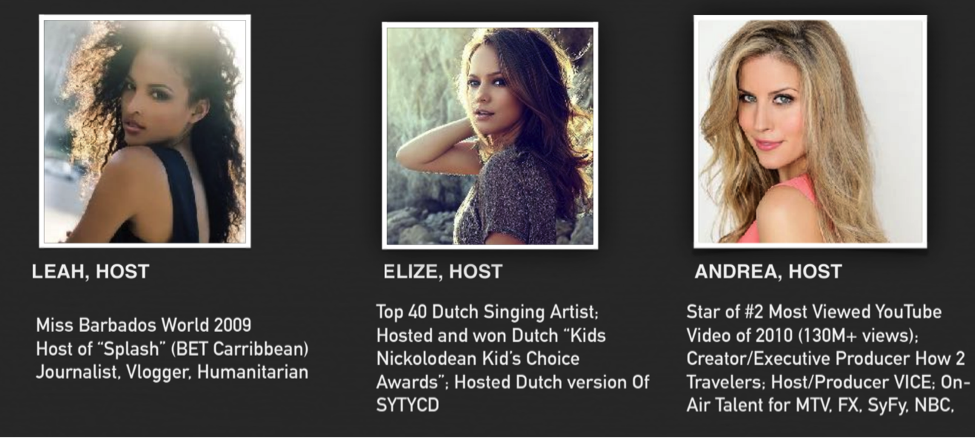

They call it the Discovery Engine. So far it’s helped them build a library of millions of files in the three years since the company started up, roughly 4,000 hours of the hottest content available on demand. Much like MTV in its prime, they’ve got attractive on-air talent in the mix to keep the kids interested between clips: beauty queens, pop stars, whatever it takes.

Once again, it’s the MTV model brought back for a new generation of viewers and investors alike. And while the original network is still around as a cog in the Viacom (VIA) empire, let’s face it, those shareholders have taken a huge haircut in recent years. That brand is old. The QYOU brand is new.

And compared to YouTube, which has leeway under the mighty Google (GOOGL) umbrella to stay a little lax about monetizing its vast video library, the QYOU team is eager to cash in on the stream.

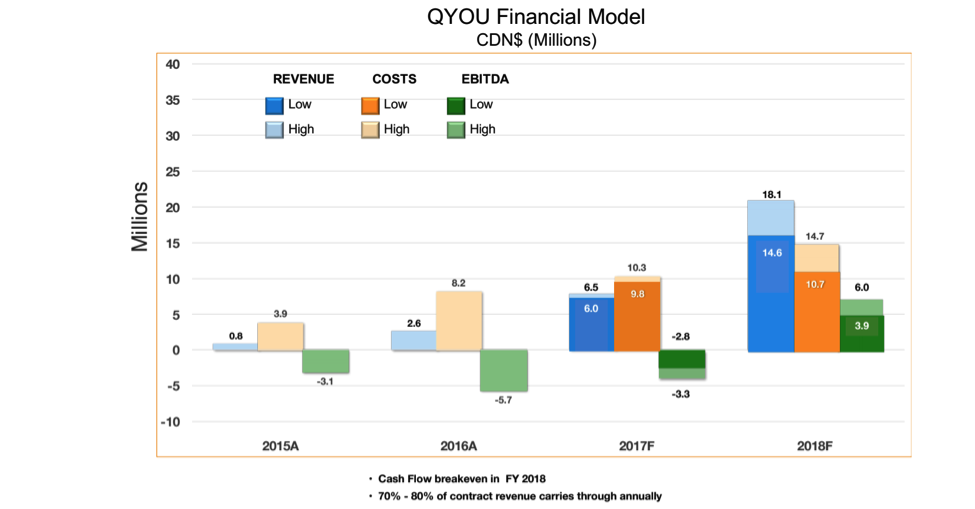

Hot take: YouTube only rakes in about $3.50 for every hour of video it serves up. QYOUF is still in the baby stages, but it ramped revenue 200% last year . . . and it’s not just pick-up ad sales, either. Thanks to long-term contracts, at a glance 70%-80% of that cash flow recurs!

There’s three revenue drivers in play here. First and foremost, there’s traditional TV-style channels, shows the QYOU team tailors for youth audiences all over the world. They opened up the Netherlands a couple of months ago. They’re in India, Australia, Mexico, Africa, 12 partnerships in Europe. HUD, their new all-video-game channel (Millennial couch potatoes call it “e-sports”), just launched in Canada. Total TV-style revenue last year: $3 million Canadian.

Then there’s the third-party programming QYOU does for Sinclair Broadcasting here in the USA. That’s the TBD channel, which started rolling out to affiliates about a year ago. It reaches 22% of all American households and you can feel the energy at TBD.com. Early stages here, but they’ve already gone from zero to $685,000.

And as the sizzle, QYOU management is very excited about bypassing stale advertising formats in pursuit of influencer marketing budgets. This is where an online celebrity like Kim Kardashian gets paid to promote your brand in her social media stream.

QYOU has a stable of next-generation icons lined up on this side — odds are good your kids know who they are. Not a huge business yet, but in a world where a Kardashian share can mean $500,000 it’s worth keeping the math in mind. Right now, maybe it’s 6%-7% of the overall footprint.

Last fiscal year that all added up to $4.1 million, easily double fiscal 2016. Management has their sights on at least tripling that cash flow in 2018 (estimates range from 250% to 340% growth) depending on how many deals in the pipeline bear fruit in the next 11-12 months. They’re targeting roughly one big contract a month, and confidence is high that the needle will start moving in the very near future.

We could see the first of a wave of announcements hit in the next few months, maybe even weeks. As the market digests the revenue bump, the window to build a true “start-up” position on QYOUF at ground-floor prices starts closing fast.

Either way, with 70%-80% of that revenue recurring once it hits the balance sheet, the ramp really trends one way: UP. And the burn rate is lean enough that it only takes about $18 million Canadian to get management hinting about “cash-flow breakeven” by this time next year. In that scenario, investors who rolled their eyes at QYOUF yesterday will need to adjust their models.

And ideally, those who listened to the lesson of how MTV went public at around 3.75X revenue and sold for close to 3X that price will be in position to reap the rewards!

We haven’t had a lot of time to get to know QYOUF on this side of the border. The company only listed on the OTC back in October. Until a few days ago, there wasn’t really enough action here to bother with. But now the chart’s come to life at last:

Not much there yet to get in a street-level trader’s way. I wouldn’t fret too much about technical indicators until there’s enough data to fill in the gaps. For some, that’s a liberating prospect. It can be fun to trade a stock that can go practically anywhere with the right wind in its sails.

I’ve talked about QYOU as a demographic story, billions of young people around the world hungry for video even if they didn’t grow up with a TV in the house. It’s a youth story, a mobile computing story, a go-go emerging markets play.

This time around, I want to leave you with a sense of the management team. These guys are more than serial entrepreneurs. They’re bona fide visionaries.

CEO Curt Marvis has won MTV awards directing videos for obscure acts like Madonna. Then he went corporate as the head of Lionsgate’s digital operation — and decided back in 2008 that it was better to work with YouTube to monetize movies, clips and trailers instead of suing to protect the rights. Without that visionary call, it’s an open question whether Netflix (NFLX) would be streaming today.

Les Garland is chief programming officer. He helped create MTV and VH1 back in the day. He’s also run Atlantic Records. A legend. He invented the MTV Video Awards, MTV Spring Break, endless buzzworthy staples of the channel’s golden age.

- Scott Patterson is chairman. He ran the Toronto Venture Exchange and took at least one start-up to a $65 million IPO. It’s worth close to triple that today. While he’s the venture capital man here, he also knows the entertainment business . . . he’s on the Lionsgate board.

These guys have done it before. They know kids, they know technology, they know the thrill of making the money happen. They want to do it now for QYOUF shareholders, who already include big wheels like cable billionaire John Malone of Liberty Media.

I get the feeling we’ll be talking about QYOUF a lot in the future. For now, though, start doing your homework . . . look at entertainment delivery trends in the emerging world, demographic patterns all over the globe. Observe the young people around you, staring at streaming video for hours at a time.

Maybe that glassy stare has been driving you crazy. Now’s your chance to build a trade around it and, just maybe, let it play a role in your portfolio. And if you missed those early wild MTV days, who knows? That 300% lightning struck once. Round Two could be just over the horizon.

Disclaimer :

This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on QYOU (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.

Capital Equity Review profiles are not a solicitation or recommendation to buy, sell or hold securities. Capital Equity Review is a paid advertiser and is not offering securities for sale. Neither Capital Equity Review nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Capital Equity Review its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.

Capital Equity Review does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.

Information presented by Capital Equity Review may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.

THIS SITE IS PROVIDED BY CAPITAL EQUITY REVIEW ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.

TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, CAPITAL EQUITY REVIEW DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM CAPITAL EQUITY REVIEW ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. CAPITAL EQUITY REVIEW, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

By using Capital Equity Review, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.

The website contains links to other related World Wide Web Internet sites and resources. Capital Equity Review is not responsible for the availability of these outside resources, or their contents, nor does Capital Equity Review endorse nor is Capital Equity Review responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Capital Equity Review be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.

You agree to indemnify and hold Capital Equity Review, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.

Capital Equity Review is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, capitalequityreview.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, QYOU Media. Capital Equity Review has been hired by a third party, Sunrise Media, LLC ., for a period beginning on January 2018 and is scheduled to end on March 30th 2018 to publicly disseminate information about (QYOU) via website and email. We have been compensated $35,000. We will update any changes to our compensation. We own zero shares of (QYOU).

Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign. QYOU Media. is a penny stock that was illiquid (little to no trading volume) prior to our Campaign, and therefore these securities are subject to wide fluctuations in trading price and volume. During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.

The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.

All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.

We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.

The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.

We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.

We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.

There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.

We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.

We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.

We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.

Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.

We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.

If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.

The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.

The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.

You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.

When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.

The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.

We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.

If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.

If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.

The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.

Capital Equity Review , reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.